Let's Talk About Twitter Stock

Editors Note: This is StoolFinance. He’ll be doing some finance blogs for us, and they are really good. He sent me his sample blog after I was talking about my IRA on Twitter and I was blown away. He’s talking about the S&P, Greece’s money problems, and all sorts of other smart people things. But at the same time he’s funny and writes in a way where it’s easy to understand. He wanted to do his first blog about something like why oil prices are changing because ISIS is bombing Russia, but I was like uhhhh, let’s start out a little lighter than that. So his first blog is fairly simple, about something we all care about, Twitter stock. Speaking of, you can follow him on Twitter here. I have high hopes for this newest addition to the site.

So without further ado, let’s learn about TWTR.

For my first blog, I figured that it would make sense to talk about Barstool’s favorite stock and the primary cornerstone behind Pres’ portfolio… Twitter, Inc. Now obviously I’m not quite smart enough to pick stocks and generate earnings day-trading on the stock market because if I was, I wouldn’t be blogging for Barstool Sports. But I can take solace in the fact that most likely neither are you. The way I handle investing is the way most people handle investing, with a diversified portfolio that focuses on eliminating nonsystematic risk and focusing on systematic risk. There will be more on the basics of portfolio management in a later blog but in short, investing in one stock and one stock only is a way of either becoming a millionaire by beating the stock market or losing half your livelihood on the whims of a CEO that has more than the shareholder interests at heart.

What is the role of a CEO?

Any garbage business school graduate or fool with a business degree can spout off the fact that “The CEO’s duty is to maximize value for the shareholders”. That may have been true in an era when valuations of companies were based on the return that a stock may provide over the course of its lifetime, but now that has changed as companies utilize equity financing as more of a “cash in” for potential success instead of a proper method of financing. In days past, stocks were focused on providing dividends from yearly earnings to the ownership group AKA the shareholders. Ergo, it was imperative that the person running the company, the CEO, designed the year to year earning cycle to maximize dividends while still providing enough money to the company to promote growth. Since interest rates were drastically higher in that time period, equity financing was a reasonable method of acquiring capital for growth. But with the era of technology, internet stocks, and the second technology bubble that we are maybe but kinda not but probably but might not be in, the value of a stock/company is not determined by the dividends that it may generate over its lifetime. Instead the value is based on the likelihood that it will go up in the near future, therefore companies will issue their stock not when they need the cash but when their potential for growth is at its greatest point.

So what the hell happened to Twitter stock?

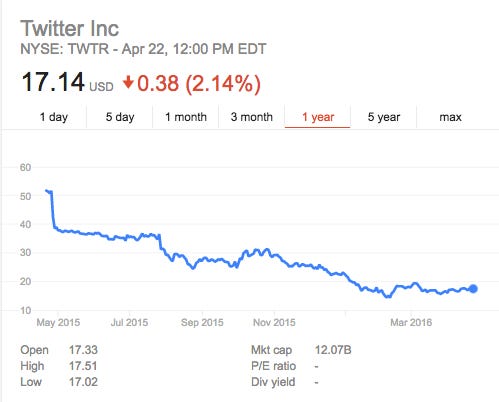

When the Twitter CEO came out and said that the projected earnings were false back in May of 2015 and Twitter will need to pivot and re-evaluate their plans, it showed that the stock was unlikely to generate income and the company was unlikely to increase in value in the near or far future. Since Twitter is an internet stock that does not provide real income to shareholders, AKA has never issued a dividend, the loss of that potential of growth tanked its stock price. I’m not saying that the loss of value in the stock price is a mark of death because, lets face it, the product is fantastic. But I do know that when your stock price is only based on how well you can do in the future, you are going to see some volatility when your CEO is bearish on your future production.

Lets cut to the chase, will it ever go up again?

If you want a buy or sell rating on a stock go hit up Rico Bosco, I’m sure he knows a guy who has some hot stock tips. But here’s the quick and dirty on Twitter’s financial statements. They aren’t making money through their day to day operations and they are running through their cash by acquiring other companies in a blatant example of inorganic growth.

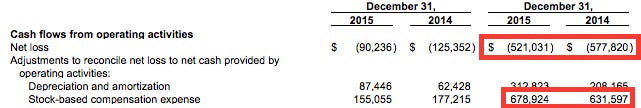

Their cash flow from operating activities was positive in 2015 but only because they pay their employees with stock more than salaries:

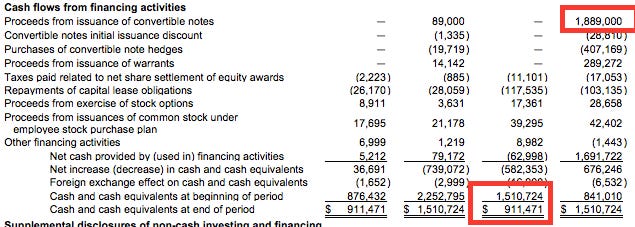

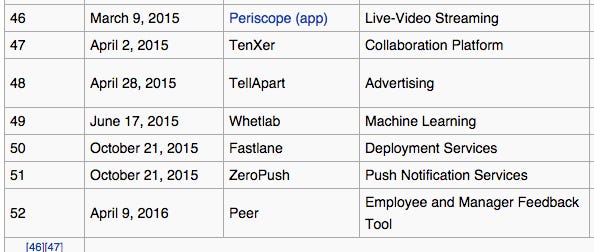

And they took a big loan out back in 2014 and have been burning through it by acquiring companies:

Which means they are trying to chase the growth monster not through organic cash flows but through debt and equity financing. You can see that this is their goal by reading the first damn line of their financial statements: “2015 was another very strong year for Twitter. Total revenue reached $2.2 billion, up 58% year over year with more than $550 million in adjusted EBITDA”. Yeah, of course your revenue grew. You bought other companies that were generating revenue for a very steep margin (according to your goodwill balance) and you’re claiming that revenue of the companies you acquired as your own. You boosted revenue but you had to spend a ton of money on acquisitions in order to do so.

Twitter is in a precarious position, on one hand they are at least trying to grow by acquiring potential revenue generators, which would cause Twitter to take a hit because of the acquisition premium, but on the other hand the company still cannot turn a profit or organic positive cash flow from their day to day operations. Essentially Twitter will live or die depending on on whether the companies they acquired will turn a greater profit for than the price they had to pay.

So if you do happen to hold a large portion of your portfolio in Twitter stock, it may behoove you to attend their next shareholders meeting… on May 25th 2016.

-StoolFinancial

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, including advertisements, shall not be construed as a recommendation to buy or sell any security or financial instrument, or to participate in any particular trading or investment strategy. The ideas expressed on this site are solely the opinions of the author(s) and do not necessarily represent the opinions of sponsors or firms affiliated with the author(s). The author may or may not have a position in any company or advertiser referenced above. Any action that you take as a result of information, analysis, or advertisement on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

And if you’re taking investment advice from Barstool Sports… it might be time to reach out to a close family member and re-evaluate some things. You know, take a break and clear your head. Just saying.